So you’re looking for the best way to invest $10,000?

Well, look no further!

$10,000 is a great sum of money to invest, if not a little on the lower side.

But I’m going to show you some little-known investment ideas to make that money go as far as possible for you!

We should all be looking at the best ways to invest our money to not only build wealth but guard against stealth taxes like inflation.

According to CNN Money, the average savings account only pays 0.06% APY (annual percentage yield, or interest).

And inflation (in the US) rose by a staggering 2.1% in 2017, after rising by 2.2% in 2016 — the largest consecutive increase since 2011.

So if you’ve stored your money in a savings account over the last couple of years, you’ve already lost 5% of the value in those dollars.

That’s $500 you’ve lost out of $10,000.

Imagine the number of people that have worked themselves to the bone to save up a large lump sum of money. Imagine how much they’ve lost to inflation over the years.

And worse still, most of them probably don’t realise how much they’re losing every year.

Traditional methods of saving money don’t really save money. The best way to save money is to invest.

Before we dive into the best ways to invest 10,000 in the short-term, let’s explore one of the most important investment concepts…

The eighth wonder of the world

These are the words Albert Einstein used to describe compound interest.

And there’s a reason why he described it as the eighth wonder of the world.

Compound interest is extremely powerful. It can create millionaire’s from everyday people that save average amounts of money.

It can be best described as interest earning interest.

So if you save $500 this month and earn $5 in interest. The next month you’ll earn interest on $505. This creates a snowball effect that can produce some incredible returns on investment.

The rate at which the interest accrues depends on the number of compounding periods. These periods determine the frequency that your interest compounds.

Case in point:

$500 that compounds annually at 10% will give you $550 at the end of the first year.

$500 that compounds semi-annually at 10% will give you $605 at the end of the first year.

And get this:

If you saved just $5000 every year on a semi-annual compound period — you’d have $1,021,553.19 after 30 years.

That’s over one million dollars.

Do you see how powerful this is?

How To Invest 10k Through Clever, Calculated Investments

Now that we’ve covered one of the most powerful investment concepts, we can dive straight into the meat and potatoes of this article.

By the end of this piece, you’ll know exactly how to invest 10k in a way that’ll produce the highest returns in the shortest possible time.

Of course, the more time you give your investments to grow, the higher ROI you receive but I’ve selected these investment ideas based on getting respectable returns over a shorter time period.

Let’s begin!

1. Invest in emerging markets

The timing of your investments is crucial to the level of returns you can expect to receive.

Emerging markets present huge opportunities to invest relatively low sums of money for enormous potential returns.

I bet you wish you invested in Bitcoin five years ago!

But with cryptocurrency, it was almost impossible to predict the explosion in value over the last few years. And I’d stay away from speculative investments that do nothing but bet against the assumption of future value.

Cryptocurrency investing is more akin to betting on horses than making an investment that produces tangible value in the form of products, services and cash flow.

Invest in the Canadian pot industry

One example of an emerging market that looks extremely promising is the Canadian pot industry.

Granted, you might not want to have anything to do with cannabis but the reality is that it’s a market with massive upside potential.

You see, unlike the states, Canada legalized medicinal Marijuana across the country back in 2001. This allowed the industry to evolve faster due to less restrictive rules and regulations.

Furthermore, Canada introduced the cannabis act in 2017 with a bill to legalize recreational use of the plant across the country by July 2018.

And with share price values for leading pot companies like Canopy Growth Corp and Aurora Cannabis Inc tripling in the last year — investors globally are scrambling to get a piece of the action.

Here are some mind-blowing stock stats for pot companies:

- Canopy Growth Corp — a 261% one-year return.

- PharmaCan Capital — a 385% rise in stock value over the last year.

- Emerald Health Therapeutics — a 388% return for the one-year period.

The Canadian pot market presents a huge opportunity to invest your money with the potential for incredible ROI over the coming years.

UPDATE 2019: Canada has now legalized recreational use of Cannabis! This industry is still very young and ripe for investment.

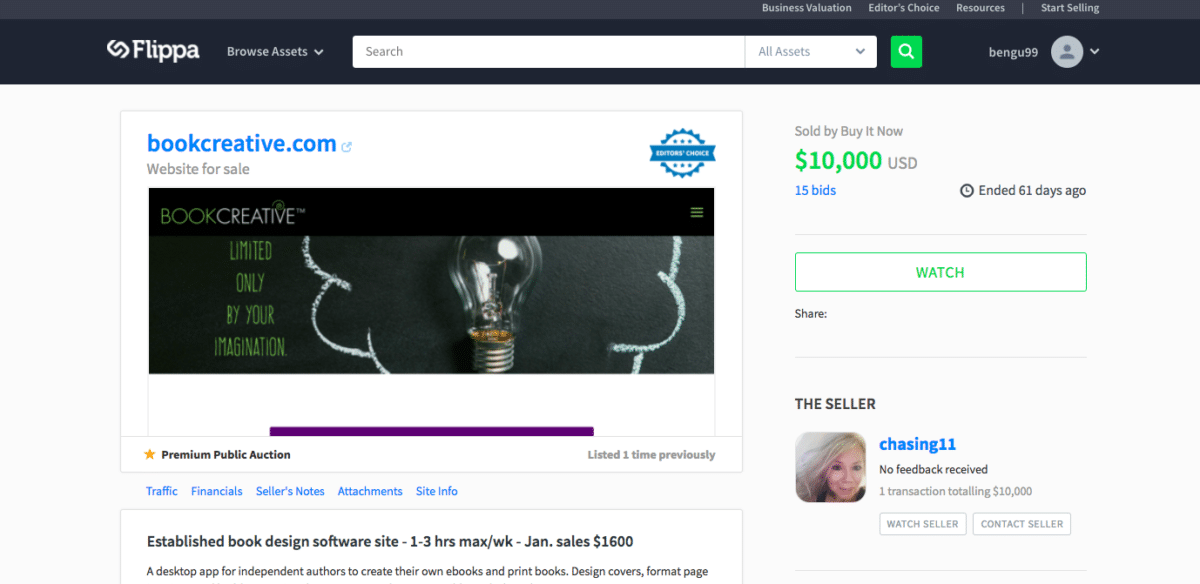

2. Invest in an online business

Did you know that can buy a cash-flow producing online business for $10,000?

That’s right. Investing your money into an established online business can be a great way to earn passive income and diversify your income streams.

So how do these websites make money?

The majority are either e-commerce businesses or websites monetised through affiliate marketing or membership fees.

$10,000 can buy you an online business that generates up to 1k per month — perhaps even a little more in some cases.

These websites are auctioned through online marketplaces such as Flippa and Empire Flippers. If you browse through these marketplaces, you’ll find all manner of businesses along with financial data, traffic metrics and monetization methods.

In my opinion, this is one of the best ways to invest 10000 for almost immediate ROI.

Check out this post for more on website investing.

For example:

Bookcreative.com is a book design software site that was sold back in January this year for a cool $10,000.

The site gets most of its traffic from US Google searches and generates an average of $1500 a month.

$1500 bucks a month for a $10,000 investment.

Can you see how incredible this is?

And don’t forget that this business can be scaled through more traffic and conversation rate optimisation.

In less than a year, you’ve already made a 150% ROI.

Now, it must be said that taking on any business is no easy feat — you need to know your stuff! But with the right skills, investing your money in online businesses can be supremely lucrative.

3. Invest in Real Estate Investment Trusts

I would say invest in a rental property but $10,000 isn’t really enough to make a down payment on a home.

Instead, you can do the next best thing — invest in a REIT!

The Real Estate industry is still one of the fastest-growing industries in the US.

REIT (or Real Estate Investment Trusts) offer a safer way for you to invest in the real estate industry without requiring huge amounts of capital.

REIT’s are companies that own or produce money-making property in a variety of industries, from offices to apartment buildings and medical facilities.

Some of the benefits of a REIT investment include:

- Higher dividend yield — trusts are required to distribute at least 90% of their taxable income to shareholders, contributing to a high average yield.

- Reliable income — rent money paid to commercial property owners come from tenants who usually sign leases for long periods of time.

- Strong performance — REIT’s have historically provided strong returns surpassing the S&P 500 over the last 25 years.

There are two main types of trusts:

- Equity REIT — companies that own or operate income-producing real estate.

- Mortgage REIT — finance money-producing real estate by purchasing mortgages or mortgage-backed securities and collect an income on the interest from these investments.

Most trusts distribute income on a quarterly basis, although some do pay monthly.

You can expect an average yield of 5%+, which is superior to the paltry averages of around 2% you can expect from the S&P 500 index.

Moreover, you’ll find many REIT’s much higher dividend yields but as a general rule of thumb, you want to focus on the ones with strong portfolios, high-quality tenants and great growth potential.

Tell me I’m not giving you great investment ideas!

4. Invest in real estate overseas

Inspired by my recent findings on Nomad Capitalist, investing in real estate overseas isn’t as risky as most people assume.

Granted, you may need a little more than $10,000 for this one but the opportunities to earn 15%+ returns annually are totally possible here.

Foreign real estate investing can be as secure as investing in the US or UK.

You just need to perform proper due diligence and be willing to hire professionals to do local research and provide recommendations for you.

There’s one main reason why investing overseas can provide annual returns of up to 20%:

Inefficiencies.

In many parts of the world, people don’t have access to sites like Zillow that provide accurate estimations of property value. Instead, these markets are limited in investment capital and as a result, provide no easy access to money for citizens.

So some people end up selling their homes for well below market value for quick access to cash.

In some markets, buyers are scarce and people need to sell. This presents fantastic opportunities for negotiating killer deals and creating those 15%+ annual returns on your investment.

Moreover, in many foreign countries, investors are too cautious to put money on the table, meaning less competition for you!

By doing proper due diligence and having the right people to help, you can find some incredible overseas investing opportunities.

5. Invest your time in starting a blog

Got something worth talking about?

Starting a blog can be a great way to invest in building your personal brand and creating an income around something you love.

Many people turn to blogging to build a business. Yes, there are blogs out there that make five and even six figures every month!

And you don’t need to create your own products to monetise your website.

Income models such as affiliate marketing allow you to build a business around products/services that you love. So you get paid simply for referring people to things that are relevant to your audience.

It helps if you’re promoting something you’ve tried yourself/things that you generally believe in.

From my own personal experience, it wasn’t easy and took a while (a good couple of years) to learn the skills required to make things work, but the rewards can be astronomical if you’re willing to put in the time and effort.

You can shorten the time it takes to grow an established blog through hiring freelancers. They can do all the heavy lifting for you so you can focus on growing your traffic.

So is blogging the best way to invest 10k?

Having that $10,000 to invest will really help you scale your content and grow the business at a faster rate, as opposed to starting from scratch.

The best way to invest your 10000 would be to buy an established blog.

If I started again, I would spend my money on a domain that already has SEO value. This way, it’ll be much easier for me to rank organically in Google for my target keywords.

Check out the full guide on how to start a blog if you want to learn more.

Related: Looking to learn more about building an affiliate marketing business? Check out this review of the Six Figure Mentors — one of the leading digital platforms for helping you start an online business from scratch.

6. Start a consulting business

Did you know that you’re already an expert?

We’re all experts in something. We all have things we can teach other people.

This is a new type of consulting. It involves solving problems for people by using your existing expertise (or gaining entirely new skills) and getting paid really well to do it.

So what does this look like?

Some examples could be:

- Coaching people to help them overcome smoking.

- Performing digital marketing services for small businesses that don’t have the time or resources.

- Helping people achieve their health and wellness goals through empowered coaching.

Starting a consulting business is one of many low-cost investment ideas.

But similar to blogging, having that $10,000 will help you scale your business faster through paid advertising methods that get your message in front of the right people, faster.

As a consultant, you set your hours, work on your schedule and can even close clients over the phone. You can also outsource the fulfilment of services so you can focus your time on getting more clients.

7. Asymmetric Investing

If you’re looking for a hands-off investment that can produce incredible short-term returns, this is the best way to invest 10000 by far.

This form of investing is unlike what you’ll find in most personal finance blogs. Most traditional methods of investing produce measly returns of 1-3%, which is hardly anything to get excited about!

The vast majority of people investing their money are playing the long game and doing it for the long-term (i.e retirement).

But what if you could take a shortcut and make huge returns on relatively small investments (like $10,000)?

What if you could invest $10,000 and get a 100% ROI in one year?

Is it even possible to do this without taking huge risks?

Say hello to Asymmetric Investing.

What is Asymmetric Investing and how does it work?

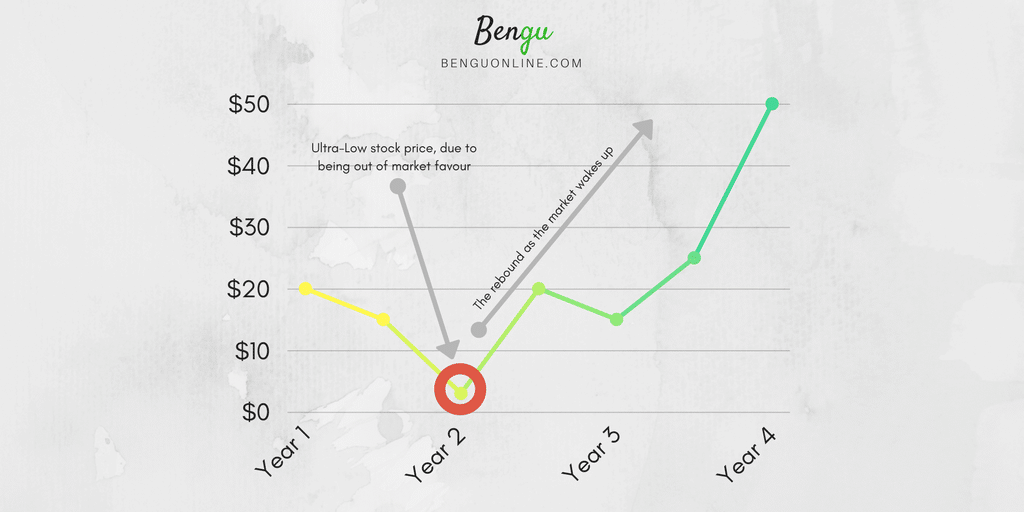

The term “Asymmetric Investing” is derived from the typical rebounding trend of share price value for assets over a certain period of time.

Many companies experience massive fluctuations in share price due to a number of factors. And in some cases, shares are priced up to 90% lower than previous highs — creating an asymmetric investment opportunity.

Here’s what a typical asymmetric investment looks like:

You’re probably thinking “there’s obviously a reason why the share price is so damn low” — and you’d be right in making that judgement.

But it’s important to note that the market isn’t rational in the short-term.

And being able to identify this is a key part of this investment strategy.

In fact, this is the exact strategy used by Charlie Munger himself (Warren Buffet’s business partner), as he says:

“You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced.”

The important thing to note here is the ability to identify assets that are priced much lower than their average market value. Assets that are usually stable with strong foundations.

If we can find these assets, it’s possible to achieve those crazy 500% ROI’s.

But these type of opportunities aren’t for the faint of heart. It takes guts to invest in a stock that looks destined for doom.

And you can be sure that everyone around you will think you’re insane for investing your money into something that’s perceived as so risky.

What the worlds elite investors think of this strategy

Some of the world’s most well-renowned investors use this exact strategy to buy stocks and shares in businesses.

Warren Buffet himself said:

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

Warren is clearly referring to investing in a stock when it’s out of favour in the market. When others are too fearful, be greedy with your investments.

He also alludes to the opposite — being cautious when others are investing like crazy in a soaring market.

Also, Philip Fisher when he said:

“Doing what everyone else is doing at the moment, and therefore what you have an almost irresistible urge to do, is often the wrong thing to do at all”

Philip was very much aware of human herd-like mentality. We’re often influenced by the decisions and opinions of others — something that can be fatal when it comes to investing your money.

The very nature of this type of investing involves observing the masses and doing the opposite.

Something that takes a real set of brass balls to pull off.

Here’s what Asymmetric Investing looks like in the flesh:

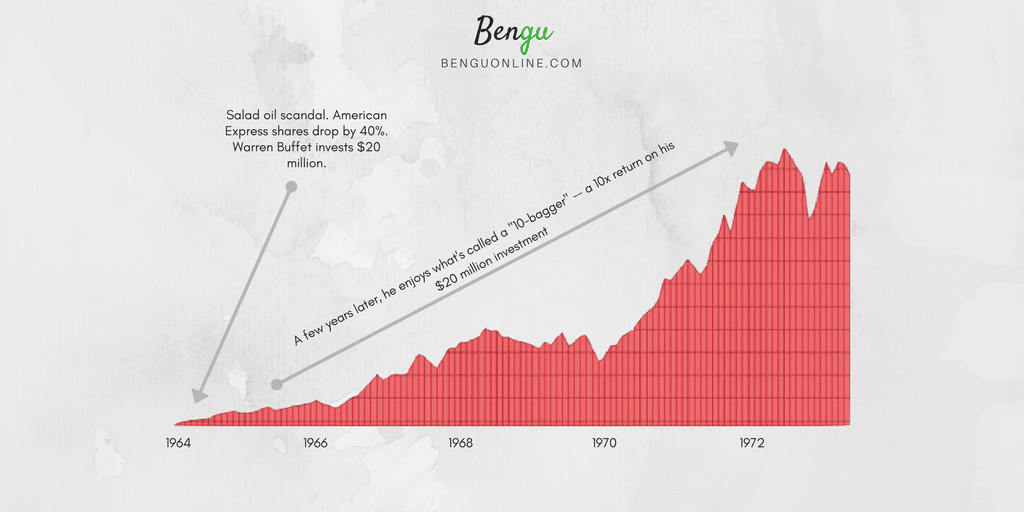

In 1964, American Express suffered from a titanic drop in share price due to the salad oil scandal. Cutting a long story short, Warren invested $20 million into AMEX at a time when nobody else wanted to touch them.

This is actually one of Warren Buffet’s most famous investments — and one that made him over $180 million dollars in profit over the course of just 8 years.

How to invest like the best (without spending billions of dollars)

Here’s one major problem with following the world’s top investors:

Most of us don’t have the market knowledge or financial backing to make the same investments.

Sure, we can gain tons of insight from the likes of Warren Buffet, George Soros and Ray Dalio.

But we can’t invest like them.

So what do we do instead?

Apply the same principles on a smaller scale of course! And with Asymmetric Investing, little money has the potential to go a long way.

The best part?

You don’t need the asset to bounce back to back previous highs to make solid returns.

You just need things to get a little better. A little better could mean doubling your money.

So why isn’t everyone doing this if it’s as good as you’re making it out to be?

Ok so here’s the problem with Asymmetric Investing:

Finding the right opportunity is like finding a needle in a haystack.

Moreover, identifying mispriced assets with asymmetric return potential is no easy task. It takes real guts to go against the market and put your money where your mouth is when other people wouldn’t touch the same stock with a ten-foot pole.

The bottom line is that most people don’t have the nerve to pull something like this off.

And even if you do — knowing which specific options to go for can be a minefield.

But what if you could stand on the shoulders of giants that have been doing this stuff for decades?

Investing like an expert — without dedicating your life to learning how

So you want to know how to invest 10k without taking huge risks?

You can leverage the expertise of people who’ve been doing this stuff for decades.

Traditionally, investments that have high return potential also come with a high risk of losing your capital.

But there are always exceptions to this rule.

One man, in particular, spends most of his waking hours finding the best opportunities for outsized returns with relatively low risk.

His name is Chris Macintosh from Capitalist Exploits and he’s a guy who can help you find some of the best investment opportunities on the planet.

Sadly, it’s hard to get access to people like Chris, and his investments are usually strictly reserved for his own companies.

And until recently, unless you had over a million dollars to invest, you couldn’t get access to his ideas.

Talk about a barrier to entry!

But this all changed when Chris launched his investment newsletter: INSIDER

Here’s a summary from Chris:

“The opportunities shared (in INSIDER) will allow you to get in on the same investments being taken by myself in my hedge fund and those on my Rolodex of friends, some of the world’s elite investors. Usually, opportunities like these are reserved for industry insiders. And it’s very unlikely that your broker has even heard of many of them, and he’s almost certainly got little idea why you’d be doing them.”

In INSIDER, Chris breaks down his investment findings into actionable steps that you can take to execute your own successful trades.

And this has the benefit of not only appealing to those familiar with the investment space but those that are just getting started too.

Furthermore, every single one of Chris’ ideas are asymmetric in nature — maximising your chances of getting incredible returns on your trades.

The future is bright for the bold and the brave

As mainstream society continues to rely on traditional investment strategies that produce measly returns, the smart minority will be making it rain by trading on nothing but the best asymmetric market opportunities.

So if you’re looking for the best way to invest 10000 with something that’s almost totally hands-off, asymmetric investing could be for you.

Just don’t forget that there’s never any guarantee of results and you must do your own proper due diligence before making any financial commitments.

Bring it all together

So there you have it!

Enough investment ideas to get you excited about making bank from your $10,000.

You should now have a rough idea on how to invest 10k — there’s a lot to think about with plenty of opportunities out there.

My personal favourites are the asymmetric investing for total passive income and consulting for active income.

What’s it going to be for you?

The choice is all yours.

I’m a London-born lover of technology, obsessed with online business, passive income and the digital economy. I love learning, researching and curating the most valuable resources to save you time, money and help you discover the truth on what it actually takes to achieve your goals.

Great content and tips that every investor can follow through it.