When you were a kid, did you hear your grandparents moan about the cost of milk, eggs and gas?

“Back in my day, we could buy 10 acres of land for 3 bucks.”

Or something along those lines.

Turns out they were right (well, maybe not about the 10 acres but generally speaking). 😁

As much as we think our elders may be exaggerating, things that used to be one price are much, much higher now.

And this isn’t just a thing of the past, we’ll continue to watch prices rise throughout our life, thanks to inflation.

But what causes inflation? And are price increases relative to our growing wages or are we truly worse off now compared to previous generations?

Either way, through conscious education and diligent research, we can learn to get ahead of inflation, avoid stealth taxes and make the most of our income.

Now, inflation isn’t what you’d call a sexy topic, but it’s just too important to dismiss!

Even the great writer, Ernest Hemingway had something to say about it:

The first solution for a mismanaged nation is inflation of the currency; the second is war. Both bring temporary prosperity; both bring permanent ruin. But both are the refuge of political and economic opportunists.

By understanding how inflation works, you’ll put yourself in a better position for future investments and know what to avoid when it comes to saving your money.

Here’s a breakdown of what we’ll cover in the post:

Lets go!

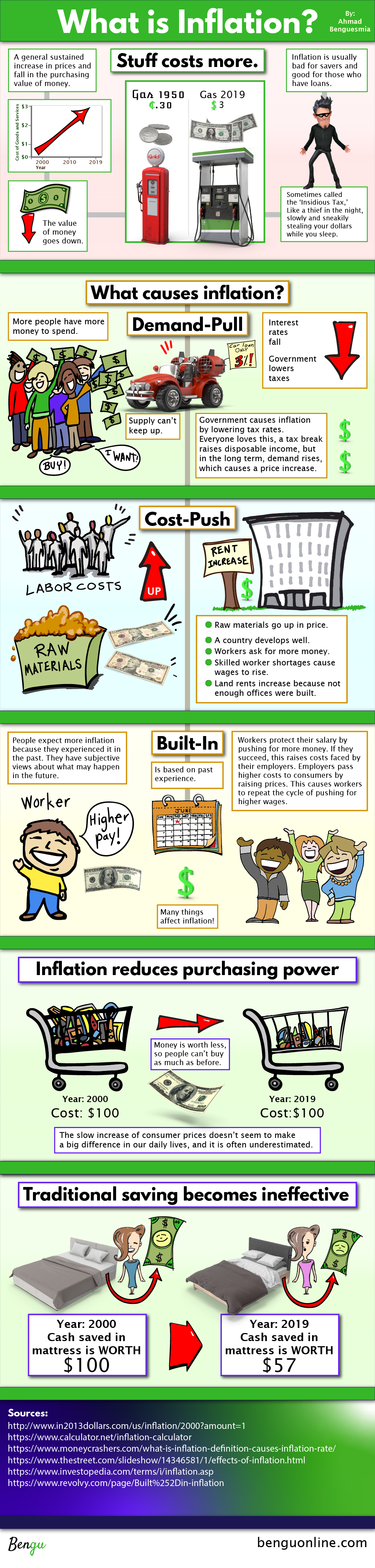

What is inflation and how does it work?

Inflation, at its core, is the rate at which prices rise for everyday goods.

It can touch clothes, food, services – anything that we purchase or consume can be impacted.

Inflation is the reason why a bag of chips that used to be 25 cents when we were kids is now closer to $1. It’s why a chocolate bar only cost 2 cents in 1908 and is closer to $1.40 now.

Many people think inflation is a sign of a good economy, but when it happens at significant rates or over short periods of time, it can be an economic disaster.

When inflation goes wrong, it can be lead to recessions and depressions.

Hyperinflation (when the value of currency falls to almost nothing) can cause massive instability in a country and destroy the savings of its residents.

What causes inflation?

So what causes inflation?

Inflation is caused by three primary factors in the global economy. Some of these factors are hard to control, others are up to our governments to decide:

1. What causes inflation – Built-in

An anticipated form of inflation that evolves based on past economic events.

For example:

Workers demand higher wages to avoid losing purchasing power and businesses pass on these costs to consumers.

This is why the average cost of a new car in the ’60s was just over $2500, compared to around $25,000 now. The price of goods was much lower but equally, workers earned much less in terms of numerical figures.

The Federal Reserve in the US sets the inflation target to be around 2% so that economic growth continues without the currency losing value.

2. What causes inflation – Demand-pull

High demand for goods and low production. Demand-pull inflation is what happens when the desire for a particular good or service is much higher than the amount that can be produced.

Demand is high, supply is low so prices get bumped up.

Aside from Demand Pull’s effect on inflation — it’s also a powerful concept used by companies globally to sell their products and services.

People want stuff other people can’t get.

An extreme example of this can be seen in Streetwear hype culture. Brands like Supreme use a combination of ultra-low supply, luxury branding and limited release windows to create massive desire for their products.

Most companies respond to high consumer demand with more product — increasing the supply in the marketplace.

But not Supreme. These guys like to do things a little different.

They have a simple philosophy:

If one of their product drops proves to be popular — never make it again.

The result?

People camp outside stores for over 24 hours to get their hands on a hoodie with a Supreme logo, a fire extinguisher or even a brick!

Yes, you read that correctly — people queue up to buy a brick with a logo on it:

And it’s not uncommon for everyday items like T-shirts to sell for over a thousand dollars a pop on reseller sites.

This is a great example of how Demand Pull is being used in the consumer market to generate enormous profit.

3. What causes inflation – Cost-Push

Closely tied with Demand Pull, Cost-Push impacts inflation when a sudden decrease in the supply increases the price of goods. This can also happen when the cost to produce a product increases but the demand remains the same.

Since companies can’t squeeze the same profit margins out of their current production, they raise the prices and pass the increase on to the consumers.

Is inflation a stealth tax?

Many people believe inflation is an effective stealth tax – by not adjusting the personal income tax thresholds for inflation, the tax rate rises under the radar.

This also affects fixed income recipients (like Social Security recipients) because the threshold isn’t adjusted and more earners are forced to pay taxes on their benefits over time.

The cost of living is always rising, thanks to inflation. So every year a government fails to increase the income tax bracket thresholds, you’re paying more tax because the value of your money is less than the year before.

This form of increased taxation is something you may have not realised and can have a significant impact on your spending power over the course of a few years.

Inflation as a stealth tax is certainly a topic up for debate, but don’t dwell on it!

What’s important for you is to understand how inflation works so you can take the appropriate steps to get ahead financially.

How does inflation reduce purchasing power?

We’ve already briefly covered how inflation reduces the value of the dollars in your pocket. But let’s take a more detailed look at how can impact your day-to-day life with a couple of examples:

Example 1 — Workers with five-year wage stagnation

As much talk as there’s about millennial job-hopping and the digital nomad lifestyle, a large percentage of the workforce remain in their roles with the same company for years on end.

If a worker hits a wage ceiling or simply doesn’t get a raise for some time — they’ll experience a lower quality of life, thanks to inflation.

It’s not hard to imagine how a few changes can impact your lifestyle.

From rent increases to the rising cost of food and gasoline — these price changes can have a serious impact on monthly expenditure and disposable income.

Example 2 — Rising tuition costs in the US relative to wages

In a more extreme example, the cost of college tuition in the US has far outpaced inflation – rising 200%+ over the last few decades.

This means a college education is more costly than ever.

And because tuition fees have outpaced wage growth, it’s now impossible for most students to work their way through college in order to pay tuition without taking on loans, creating a multi-generational student loan debt burden.

According to the National Center for Education Statistics, the average cost for a four-year degree for 2015/16 totals a gigantic $104,480.

The cost for the same four-year degree in 1989 was just $26,902 and $52,892 when adjusted for inflation.

This means the true cost for your average degree has doubled, compared to 30 years ago.

The explosive growth of college tuition fees coupled with the lack of wage increases for jobs has created the worst economic conditions for university students.

The worst ways to save your money

Thanks to the way inflation impacts your purchasing power, it’s critical you’re savvy about how you save your money.

To kick things off, let’s have a look at some of the big no-no’s when it comes to inflation-busting savings:

Stacking it in your mattress

This may sound like a joke, but according to a poll from American Express, 43% of people surveyed are keeping part of their savings in cash – with over 53% of those responders hiding it in secret locations around their house!

Mattresses, freezers, the basement. All of the places.

At face value, this may sound silly. But not everyone lives in a sprawling city or an area with quick and easy access to banks, ATMs or stores that accept credit cards.

While there can be value in keeping cold, hard cash around in case of a crisis, this should be done on a micro level. And it certainly shouldn’t be the only way you save your money.

Stockpiling fat stacks of cash is unsafe and certainly won’t help you beat inflation.

Using a savings account

Putting your money in a savings account is definitely a step-up from stuffing dollar bills in your mattress.

Why? Two main reasons:

All banks provide insurance on cash deposits (up to a certain amount), and because savings accounts offer the opportunity to earn interest, this can help offset some of the buying power lost through inflation. With emphasis on some!

Unfortunately, most high-street banks don’t offer more than 2.5% in savings interest (and that’s the creme de la creme of savings accounts).

Nowadays, most offer rates closer to .25%.

While 2.5% is certainly better than .25%, neither is enough to help you get ahead of inflation. At the absolute best, you’ll stay fairly close to it.

Investing in traditional stocks and bonds

The stock market is certainly better than the other options on this list – it generally outpaces inflation, and while bonds are much safer lower-return asset classes, stocks can historically provide anywhere from 7-12% over the long-term.

If you’re going to invest in one thing from this list, stocks are a satisfactory option. But can we do better?

Why most people never get ahead financially

Don’t you just love a good moan about the economy, the government or the tax system?

Let’s be real, we all love to complain about things. In a strange way, it brings people together through shared pain and frustration.

But when complaining becomes a substitute for action — it becomes toxic. Too many people complain about their financial situation like they have no control over it.

“I’m broke because the IRS are bleeding me dry dude”

“The economy sucks! That’s why I’m poor bro”

“The system is rigged against us! It’s the Illuminati!!”

It’s funny because I can relate to these statements in a huge way. Growing up in South London, we never really had much money to spend on things. And my dad was a MASSIVE conspiracy theorist.

Everything that ever happened supposedly had some sort of grand behind-the-scenes plan to target the poor and give to the rich. Of course, everyone in the government was totally corrupt. The system was evil. And the Illuminati was out to steal our daily bread.

Eventually, I realised my dad was a nutcase and most of the claims he was making were untrue.

And so — much of my personal finance journey has been to unlearn the false information that was fed to me growing up.

Maybe you can relate?

You may have a poor relationship with money simply because you’ve been taught that money is scarce. Money is evil or money is hard to earn.

But the truth is, money is everywhere. And winners don’t complain. They take action.

They take the time to understand the financial landscape, analyse their best options and take meaningful steps to improve their situation.

Little-known ways to stay ahead of inflation

Speaking of winners, if you want to join the club, you’ll need to learn some powerful strategies for investing your money.

What you choose to invest in is ultimately your choice. One of the main factors to consider is how much work you’re willing to put into this investment.

Perhaps you’d like it to be as hands-off as possible so you can earn passive income and focus your efforts on your current projects.

Or maybe you’d like to invest in a project with more potential for growth and higher ROI over the short-term.

The latter typically requires more time and effort to execute but can still be turned into forms of residual income through outsourcing and systematisation.

With all that said, let’s have a look at some powerful ways to invest your money:

Asymmetric Investing

Asymmetric investing is just different. It’s counterintuitive. It doesn’t make logical sense.

But its the strategy used by some of the top investors on the globe.

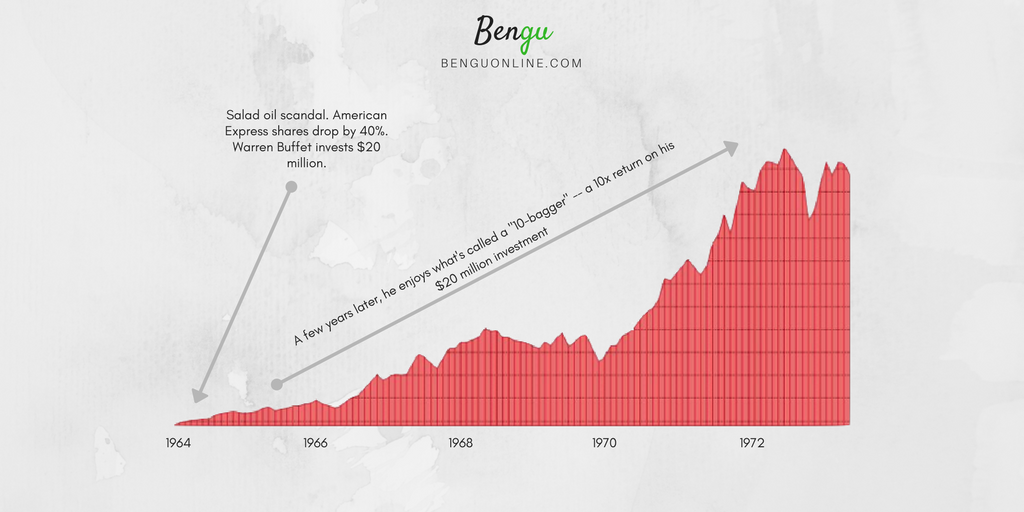

This form of investing is how Warren Buffet himself sealed his first huge financial win during the Salad Oil Scandal for American Express.

In a nutshell, American Express were going through a huge downturn thanks for being involved in a scandal with a corrupt soybean oil company called Allied.

At this low point for American Express, Warren purchased a 5% stake in the company for $20 million and made a 10x ROI over the course of just 8 years:

Warren made over $180 million in profit from this one investment.

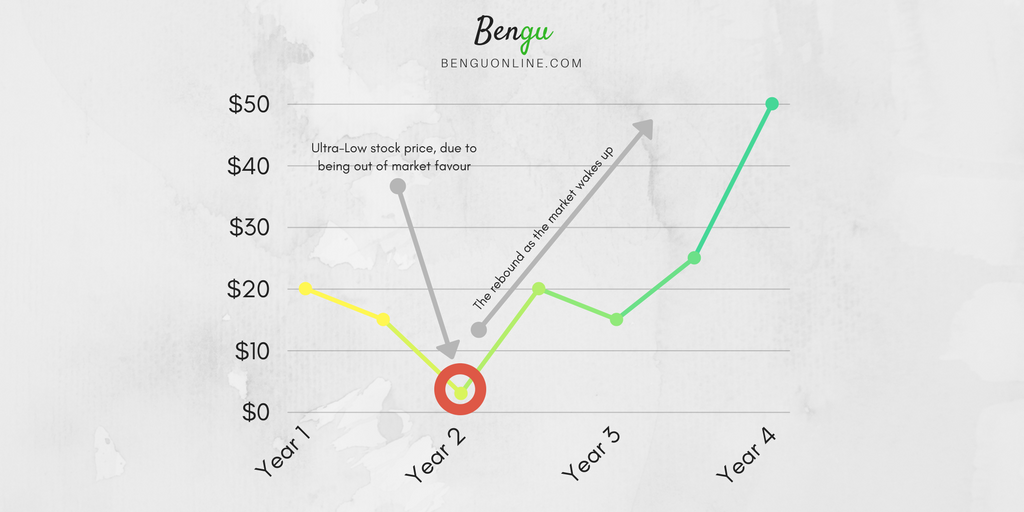

Asymmetric investing as a strategy involves taking advantage of irrational short-term market fluctuations.

In plain English, this means investing in a company/asset when their share prices are unusually low. And not just any company that suffers from a drastic drop in share price…

You’re looking for assets that are typically stable with solid foundations. Assets priced much lower than their average market value.

Here’s an example of what an asymmetric investment could look like:

The ability to identify these assets is where the gold lies — and if you can find them, it’s possible to achieve an insane ROI in a much shorter space of time compared to traditional investing methods.

I go into more detail on this investment strategy in my post on the best ways to invest 10000.

Buying an online business

Have you ever thought about buying an online business instead of building one from scratch?

Websites like Flippa and Exchange Marketplace are auction sites where people list online businesses they would like to sell.

You’ll find all sorts here — from affiliate marketing to membership sites and full-blown private-label e-commerce businesses.

You can buy an online business for as little as a few hundred dollars. Conversely, larger, more established businesses sell on the site for well into 7 figures.

Typically, the sale price is calculated by doubling/tripling annual profit (with a few exceptions).

So your return on investment can be recouped in two to three years (in some cases much sooner than this). After that its pure profit for you.

Buying an online business is a turnkey solution to entrepreneurship. The hardest part (building the business from scratch) has already been done for you.

However, a word of caution.

Purchasing an online business is no joke and works like any other business. You need to understand the market and have the skills required to move the company forward.

There are also a number of due diligence steps you must follow before you commit to buying anything.

This is why if you’re new the world of digital entrepreneurship, I HIGHLY recommend you start your own business first before thinking about investing in one.

I can’t tell you how valuable the skills you learn will be for you. Skills such as copywriting, email list building and content marketing that will stay with you forever.

And these skills can be applied to almost any type of business.

The side hustle

Building your own business on the side is the best way to safely test new ideas, learn new skills and create something awesome while maintaining a decent quality of life.

Forget about blindly following your passion and quitting your day job.

Your 9 to 5 isn’t as horrendous as those course owners make it out to be. And there’s so much value in having that stable income that you can use to not only support yourself but invest in your side projects.

Now:

When it comes to starting your own thing on the side, you have an overwhelming amount of options available to you.

Whatever you decide to do, make sure you stick to one thing and MAKE IT WORK.

Too many people jump between different opportunities expecting magical things to happen. There’s no quick fix. And no matter what course you take, there’s no escaping hard work.

The humble side business is one of the best ways you can invest your money.

Why? Because you’re creating something that can provide an income for the rest of your life.

And if your side project kicks off, it can replace your full-time income and allow you to live life totally on your own terms.

So what are some solid, time-tested ideas for creating a business on the side?

I’m glad you asked!

Private-label e-commerce businesses

When it comes to e-commerce, you’ve probably been exposed to a lot of content surrounding dropshipping. And with that, you’ve probably heard that its either the next big thing OR an industry saturated with competition.

Want to know the truth?

Dropshipping is too easy, which makes it a terrible business model.

That’s why everyone and their mum is doing it and most are making very little to nothing.

Dropshipping is basically acting as an intermediary between a supplier and a customer.

You launch an online store that lists a bunch of products sourced from sites like Aliexpress. And you use branding and marketing to attempt to separate yourself from the insane levels of competition.

You make your money by marking up the product price from the wholesale price you pay for the goods. When a customer buys from your site, the product is shipped directly from the supplier to the customer.

The problem with this model is your margins are very thin. And this is just the start.

Dropshipping, as a business model on its own, is flawed for a number of reasons:

- Barrier to entry – With dropshipping you don’t need to pay for inventory so it costs almost nothing to start. At face value, this seems like a great thing but it attracts a truly crazy level of competition.

- Price wars — Again tied to Dropshipping’s barrier to entry, many business owners find that this business model quickly becomes a race to the bottom with razor-thin profit margins.

- Differentiation — You have no way of separating yourself from your competition because you cannot make changes to the product. This makes it almost impossible to build a brand and offer any sort of value-add to your product line.

These are just a few of many reasons why dropshipping isn’t the best business model for e-commerce.

Enter private-label products

Private-label products are a totally different breed of e-commerce business. These are the popular e-commerce brands you’ve likely heard about in the past.

Companies like Cards Against Humanity, SkinnyMe Tea and Dollar Shave Club.

Private-label products form the foundations for these well-known brands.

So what are private-label products, exactly?

Essentially, a third-party manufacturer produces the products that you sell under your own brand name.

You’ll find private-label products in almost every consumer category, from shampoo to beverages and cosmetics.

Private-label is big business.

And many aspiring entrepreneurs are doing extremely well by establishing private-label brands through Amazon FBA.

So why is private-label superior to dropshipping?

A number of reasons:

- Production and pricing — Third-party manufacturers work based on your direction, so you have total control over quality of materials/ingredients…etc.

- Pricing — Your choices when it comes to production control determine product cost. You also have control over pricing and overall profitability.

- Branding — This one is huge. Branding allows you to move away from selling raw materials and transition to highly profitable, value-added products. This makes you more resistant to price wars and competition. You also have total control over packaging design.

- Inventory requirements — Private-label requires the ordering of product inventory, this means you’ll need to spend money on testing and product stock. While this can be seen as a downside, it significantly reduces the level of competition.

With all that said, selling on Amazon is no walk in the park and you’ll need to learn the skills to help you do it successfully.

You’ll find tons of courses out there — one of the more popular examples being Amazing Selling Machine (I’ve purchased this course and done a review if you’re interested).

Overall, e-commerce is still full of incredible opportunities that are ripe for the taking. And private-label is the way to go if you want to create a successful long-term brand.

Rounding things off

Inflation, at it’s worse, can be scary – recessions, depression, government and political instability. But hiding your head in the sand or waiting for a bailout to save you isn’t the solution – proactive action is what creates real change.

Now that you understand the landscape, you’re armed with half a dozen ways that you can move forward and protect yourself against inflation with candour and confidence.

Whether it’s through investing, buying a business or building your own – you can start working on building a future of financial abundance.

Start today by picking one of the strategies above. But whatever you do, don’t store your money in a goddamn mattress.

I’m a London-born lover of technology, obsessed with online business, passive income and the digital economy. I love learning, researching and curating the most valuable resources to save you time, money and help you discover the truth on what it actually takes to achieve your goals.