Imagine never having to worry about your finances ever again.

No more worry, stress or anxiety relating to money. You’ve got enough to cover your expenses, any emergencies that come up, and then some.

You’ve achieved financial freedom and long-term financial security.

What would that feel like?

Bliss?

They say money doesn’t make you happy, and while it’s true that happiness is mostly to do with your belief systems and perspective on life, there’s no denying the life-changing value of money.

Money gives you options in this world. It buys you something even more precious than money.

Time.

Time to do the things you want to do.

Whether it’s pursuing that hobby, building that business or help make the world a better place, money affords us the freedom to do what we want, when we want.

Financial freedom means you have enough cash-flow to comfortably afford your current lifestyle without a worry in the world.

It also means you aren’t tied down to a job that sucks the life out of your soul.

What’s the point of earning a six-figure salary if you don’t have the time or energy to spend and enjoy it?

Sometimes we get so caught up in our careers, we lose sight of the things that really matter.

So, what does financial freedom really mean to you?

is it:

- The freedom to work from anywhere for as long or as little as you want.

- The ability to write your own pay cheque and not have your potential capped by a salary.

- More time to spend with your friends and family.

- Being able to travel the world and focus on the things that are meaningful to you.

- Not having to worry about your finances ever again.

- The freedom to work from anywhere for as long or as little as you want.

- The ability to write your own pay cheque and not have your potential capped by a salary.

- More time to spend with your friends and family.

- Being able to travel the world and focus on the things that are meaningful to you.

- Not having to worry about your finances ever again.

It’s likely more than one of these things — nevertheless, freedom is the common underlying theme.

Having the freedom to choose what you want to do in your life, instead of being a slave to the dollar.

That’s powerful.

How technology has transformed the financial landscape

When it comes to the current financial landscape, most people operate under false pretences and assumptions.

How? Because technology has completely changed the way we conduct business and make money.

Heck, it’s completely changed the way we do everything.

The advent of the internet has turned the traditional model of business on its head.

You don’t need ten years, huge start-up capital or even expert knowledge to build a thriving business and make passive income.

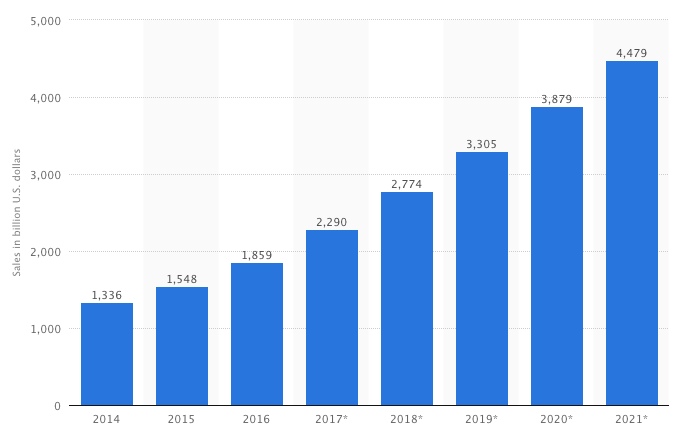

Taking the world of e-commerce as an example. The below graph reveals data collected by Statista, showing the insane numbers the world of retail e-commerce is producing (companies like Amazon, eBay and Groupon). 1.8 trillion US dollars in revenue generated in 2016. And it’s projected to generate over 4.4 trillion by 2021.

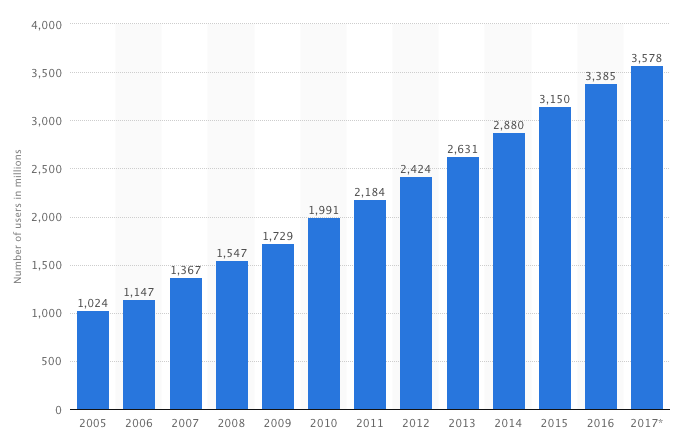

This next graph shows how internet usage has exploded over the last decade. Internet uptake has almost quadrupled. With over 3.5 Billion internet users in 2017. That’s more than half the entire planet!

These raw figures paint a picture that helps us understand the sheer speed and scale of change our world is experiencing. And to think, the internet has only been around for roughly 15 years.

So it is still a baby.

Why most fail to achieve financial freedom

When it comes to financial freedom, lack of education is an epidemic. Sure, most of us have attended school and even college but the traditional system of education is rigged against you.

Put simply, at school we’re conditioned to learn to work for money. We aren’t taught how to make money work for us.

The current school system adheres to the century-old, factory model of education. Back in those days, students attended school to graduate as factory workers.

This model of education is clearly out of date!

It’s shocking to think that our educational system hasn’t gone through any significant changes over the last few decades, despite the technology revolution.

There are many myths surrounding money that keep people financially trapped in their lives.

Poison-drip consumer culture

We live in a culture of consumption obsession. No wonder they call us consumers!

People trample over each other on Black Friday to save $200 on a TV. Mass-scale marketing encourages mass consumption. The material possessions we obsess over depreciate faster than a falling brick.

Obsession with consumption leads to a depleting bank account and accumulation of stuff you just don’t need.

Comparing the mindset of a typical consumer with one of an entrepreneur paints an interesting picture of the differences in approach to money and life:

A different type of education

One of the tremendous gifts of the internet is the ability to learn almost anything at the touch of a button.

Successful people understand the power of self-education and accountability.

They take full responsibility for their situation. They acknowledge where they are and know they can transform their circumstances for the better, through taking action and creating positive habits.

If you take a look at the business landscape of the world, generally, you’ll find that the most successful companies are the ones that specialise in a particular field.

People pay more for specialists because they know their stuff.

Specialist knowledge is available to everyone now because the internet has made everything transparent.

For example:

Online training courses like the Amazing Selling Machine and Sam Ovens Consulting Accelerator teach you practical mental and entrepreneurial skills that can be directly applied in business.

So instead of learning from traditional textbooks — you’re gaining cutting-edge knowledge from people who’ve built multi-million dollar businesses from scratch.

One of my favourite quotes comes from the late and great entrepreneur, Jim Rohn:

“Formal education will make you a living, self-education will make a fortune.”

Jim regularly spoke about self-education at his seminars and conferences. One thing that stuck in my head from watching his talks was the concept of providing value.

When we work on our personal and professional skills, we become more valuable to society.

And ultimately, we grow our finances equal to the growth of the value we provide.

What separates the winners from the losers

Three fundamental principles form the base of your mental makeup. Your relationship with these principles have a huge impact on how you view and respond to life as well as what you achieve.

These principles are:

Your Self-awareness

The ability to be introspective with yourself. Having a high level of awareness is crucial to identifying your sticking points and growing as a person. How can you improve when you don’t know where you’re going wrong?

Not having this quality makes it difficult to change for the better because you won’t see things as they are.

For example, having an awareness of your lack of productivity is the first step towards improving the behaviours that aren’t serving you.

It’s easy to blame something external for your failings when you don’t realise how you’re sabotaging yourself.

Self-aware people are level-headed and brutally honest about their strengths and weaknesses. And they aren’t afraid to be open about them because they know they can improve in places they’re lacking.

Your Beliefs

One of the most powerful and creative forces in the entire universe. Beliefs form the foundation of our lives by altering our reality based on what we think is possible.

The problem is that most of us have taken on limiting beliefs from our upbringing, social circle and environment.

Many of these limiting beliefs are subconscious, operating in the background unnoticed, sabotaging our desires, goals and aspirations.

Your Perception

The way you perceive your reality through your senses has a tremendous impact on your life.

Perceptions are the way we view things. They form our experience of this world because we create thoughts, feelings and experiences based on it.

Someone with a negative perception puts more focus on negative events and outcomes. This focus makes the person see the bad in everything and miss out on all the good. It’s a filter that we experience life through. And it’s our job to make sure that filter is clean!

How people achieve financial freedom

Financial freedom has two main rites of passage.

The traditional route is to listen to what your parents told you. Go to school and go to college so you can get a degree and work your way up the greasy corporate pole.😓

I’m not against working a corporate job. I’m just biased towards another route that’s much faster and more fulfilling (in my opinion).

For some people though, this option works just fine.

The biggest downside to working your way up the corporate ladder is that it takes time. It can take 20-30 years to get to a salary that provides the financial freedom and flexibility you want.

You’ll also have to deal with the prospect of being made redundant, as well as office politics and other red-tape nonsense.

Becoming financially free in the short-term

The second rite of passage for freedom is through the world of online businesses!

Online business eats the corporate career for breakfast.

Building (or buying) and online business is the fastest way to build a consistent stream of income in a short space of time. Not to mention no salary caps and practically unlimited earning potential. There’s nothing else quite like it.

Business also offers something that a corporate job will never have. The ability to create passive income streams. In the world of business, we can systematise and automate key tasks that mean we can generate an income without being actively involved.

Models such as Affiliate Marketing, Consulting and Drop-Shipping have changed the way we start, run and grow businesses

They all offer higher profit margins, lower overheads and more flexibility compared to their traditional counterparts.

And if you don’t have time to build something on the side — you could learn the best ways to invest your money.

Small amounts like $10,000 can go a long way.

The foundations of wealth

People that enjoy long-term success have a sound understanding of two important concepts.

Financial literacy and human psychology.

Financial literacy is all about your knowledge of controlling, investing and protecting your finances. Another thing that the traditional school system fails to teach us.

Having financial resources is one thing. Knowing how to leverage those resources is something else.

The cornerstones of financial literacy are as follows:

Assets vs liabilities

The distinction between an asset and a liability is huge. I have a simple explanation for the two that I’ve borrowed from the famous Robert Kiyosaki!

An asset is anything that puts money in your bank account. A liability is anything that takes money out of your bank account.

It’s that simple.

Most of us assume that our house is an asset. Your house is actually a liability.

Why? Because it takes money out of your bank account each month. Even if you own your property outright, you still have to fork out for bills and maintenance.

A rental property can be an asset if it puts money in your bank account at the end of the month after the mortgage, bills and everything else is paid.

Capital gains vs cash flow

Financially savvy people invest for cash flow, not for capital gains. Investing for capital gains is like investing in the stock market, you don’t really know if it’s going to go up or down.

For example, people purchase a house hoping it’ll increase in value over the years. Before they sell the house they’ll have to pay the mortgage and any other expenses out of their own pocket.

At this stage, the house is a liability.

The problem with investing for capital gains is that you have no control over the end result. You don’t know if the value will rise or fall. And if you do make a profit, you pay the highest amount of tax on it.

The best thing to focus on is cash flow.

For example, you invest in real estate property with the bank’s money. You find tenants to cover the expenses and make a profit each month. The property becomes an asset.

If there does happen to be a capital gain when it comes to selling, that’s a bonus because you’ve already made money from the property.

Investing for cash flow gives you control over your income and ensures a positive return on investment.

Good debt vs bad debt

Yes, good debt exists!

But first, what’s bad debt?

Bad debt is borrowing money to spend on anything that won’t put money back into your bank account. This is a liability investment. They include things like financing a car or buying appliances on your credit card.

Contrary to popular opinion, not all debt is bad. Debt can be a valuable asset if invested properly.

You can leverage debt to invest in things that will put money back into your bank account. Like rental property.

By using the bank’s money to purchase a cash-flowing asset and only paying a deposit, you use much less of your own money. You’re then able to acquire tenants who can pay off your debt while you own the asset, and retain any profits.

Understanding what makes people buy stuff

The second concept you must master for financial freedom is human psychology.

This applies to anyone interested in building a business.

Understanding what drives us to make buying decisions is the holy grail to all marketers. The best marketers live and breathe this knowledge. They use it to implement crazy effective marketing strategies that convert like gangbusters.

Knowing how to market a product is more important than the product itself.

How? Because the best product in the world won’t sell if the marketing doesn’t connect with an audience.

On the flip-side, many mediocre products have done extremely well because of powerfully clever marketing strategies.

Why now is the best time to start

The internet is ripe with opportunity. The barrier to entry for business has never been so low. Various tools and resources available to us remove the requirement for being computer savvy.

We all have access to powerful blueprints for building successful businesses.

You don’t need to kill yourself trying to figure out everything on your own. While there’s still heaps of doom and gloom in the mainstream media about our economy, there’s no denying the immense opportunities for creating long-term, scalable, sustainable wealth through business.

So what are you waiting for? Your wild life of freedom and flexibility awaits!

I’m a London-born lover of technology, obsessed with online business, passive income and the digital economy. I love learning, researching and curating the most valuable resources to save you time, money and help you discover the truth on what it actually takes to achieve your goals.

Another fantastic and informative post. You are officially my all time favorite blog. And I can honestly say that I have never even had a favorite blog before so this is a first for me, one – to even like a blog enough that I read just about every word and two – I enjoy it so much that I can without a doubt and without any reservation say it’s my favorite blog and it’s almost certainly not going to be beat by another. You go way above and beyond in my opinion and to top it off your site… Read more »

Wow…. that really touched my heart Amanda. Thank you for taking the time to leave such a heartfelt comment and I’m proud to call an awesome human like you my biggest fan haha. Everything about the blog has been a constant process of evolution. When I started blogging, the site looked bad, my writing sucked and nobody was checking out my stuff. I’m 100% sure I started from a lower point than the average person in terms of my marketing skills — but I just kept going. I kept learning and growing personally which gave me the ability to offer… Read more »

I would have to agree with you about Ahmad.

Wow…. that really touched my heart Amanda. Thank you for taking the time to leave such a heartfelt comment and I’m proud to call an awesome human like you my biggest fan haha. Everything about the blog has been a constant process of evolution. When I started blogging, the site looked bad, my writing sucked and nobody was checking out my stuff. I’m 100% sure I started from a lower point than the average person in terms of my marketing skills — but I just kept going. I kept learning and growing personally which gave me the ability to offer… Read more »

A great article, which has all the knowledge I have gained by reading many books, watching many videos, listening to some podcasts and reading a lot of articles. Thanks for your efforts to create this article.

This article is now in my collection of resources.

Hey Kuldeep — yes, much of this information comes from books I’ve read over the years. I’m glad you enjoyed the read and got some value out of it :-)

I have been following your blog for some time. Keep sharing, keep writing and yeah keep sending mails too , because this is the only way I can reach to your great articles.

me too,i have found this so amazing

I am going to do the same. Follow!.

A real cool article One of the best I’ve read.

Ahmad you are the man. I enjoy the reading. It reminded me of the many conversations I had with Mr S (Walter H. Shorenstein) when I work and house sit for him. A billionaire who made his money in commercial real estate and lived in San Francisco I also worked in the mailroom. Many times I would ride him home because I lived there after his wife died. We had many talks about life, being a Jew and making money. What you wrote was very interesting. I also met a lot of high powered people because of him. I talk… Read more »

I personally enjoyed the informative information, it is very good compiled and easy to follow. I wish I had this information a long time ago before burning my fingers on some business ventures. Thanks, Bengu for this masterpiece

Uplifting & informative as always. Indeed I don’t think it’s possible to be disappointed in this blog. Keep it up Ahmad, you are truly something else.